Partners Make Peace and Plans with Money

Toolkit for Money in a Relationship

When we get real with people, money comes into the picture. Our financial realities, money stories, and economic experiences swim around us and tend to bump into other people’s ways of doing things.

Why?

Because each of us has a unique approach to money, informed by lots of things.

Sometimes we’re aware of it, sometimes we’re not. Usually it only matters to us when we’re trying to make a positive personal change or are experiencing rough financial times. But, our approach to money also stands out when we want to do things like:

- Move in with a sweetie or friend and share household costs…

- Buy a house, RV, collective art space…

- Save up to have kids with our co-parents…

- Plan to take a vacation or take the band on tour…

- Think through taking care of and ~gasp~ retiring with someone(s) as we age…

Making plans together – whether with a romantic or platonic partner, a roommate, or a collaborator – is a GREAT way to see those plans through. It makes it more fun! It makes it easier on all parties! It … makes the paperwork more intense…!?

It means you need:

- self-knowledge and ways to show up to conversations that may be challenging or just plain complex

- a practice of talking about things that lets you be be real, honest, and stay on the same page

- explicit plans and agreements, even when the plan is “we need to learn how to make our plan”

- a feeling that the light at the end of the tunnel is gonna be that soft, rose-tinted light that makes everything lovely and the story end happily

This, friends, is why I’m thrilled to be sharing …

The Partners Make Peace and Plans with Money Toolkit for Money in a Relationship

If you feel that talking about money with our partners, roommates and close friends is a great way to:

a) learn to be resilient, share money hacks, and plan to get awesome things together (hopefully)!

b) enter a potential hellmouth of navigating differences, confusing decisions about fairness and equity, and missteps (maybe)...

c) all of the above?

Then you're going to LOVE the support you get in this toolkit!

Get started now!

Bust out your journals, friends - you're about to get SO READY TO MAKE PEACE AND PLANS WITH MONEY!

This online toolkit provides a massive level of support and guidance, including:

- Warm-up self reflection materials

- Agendas for five meetings, including prep work, guided conversation starters, and next steps

- Six worksheets covering an equity assessment, setting shared budgets, calculating how long/how much a big savings goal needs to get to

- Five readings including: conversation agreements, discussion prompts, a HELP This Is Hard guide, Tools to Use, a Stories section

- Videos to underscore your learning

- Ways to talk about class, resources, and expectations that are respectful for everyone

- Design instructions to create peaceful and actionable plans around money

- Video instruction, including a workshop,

four meeting prep modules, and a live partner dialogue example - Several calculators for you and your people to easily crunch numbers together

- A five-step meeting guide with agendas, prep work, and homework prompts

- A 30-page self-reflection and conversation guide with starters and helpful questions

- An equity-based budgeting worksheet for people with very different resources

- BONUS: A legal agreements worksheet and podcast and

- Helper materials on accounts, insurance, navigating tough conversations and more!

- And more!

Real talk and support? You got it.

Having worked with tons of real-life partners, this toolkit is PRACTICAL as heck. You all need it, I know!

Throughout your work, you've got a roadmap and videos to kick you off and keep you going every step of the way. There are multiple real-life stories and examples of how others have handled everything from:

- A major savings goal (down payment? children? - they're in here!)

- Talking through coming from really different economic backgrounds

- Deciding how to split costs fairly

- Making life plans

This course can:

- Give you a clear path to start, create, and maintain a system for using money with people you care about.

- Help you define and test solutions and approaches for the shared goals you have

- Know, understand, and deepen respect for the various ways you and other people approach money

- Build mutual agreement on the things you will do

- Let you skip over a bunch of couples’ therapy sessions, fights, and awkward emails.

This course can’t:

- Bestow more money on a tight budget, though it can give you a way to look at the money together that’s collaborative instead of judgmental, and make handling a tight situation easier on your relationship.

- Make capitalism fair. It’s a fundamentally unequal system, after all. However it can give you tools to name what’s not right, honor each others experiences, and meet in the middle to go get what you want together.

- Address deeper situations of non-consent, abuse of power, or replace therapy where it’s really needed. Real talk.

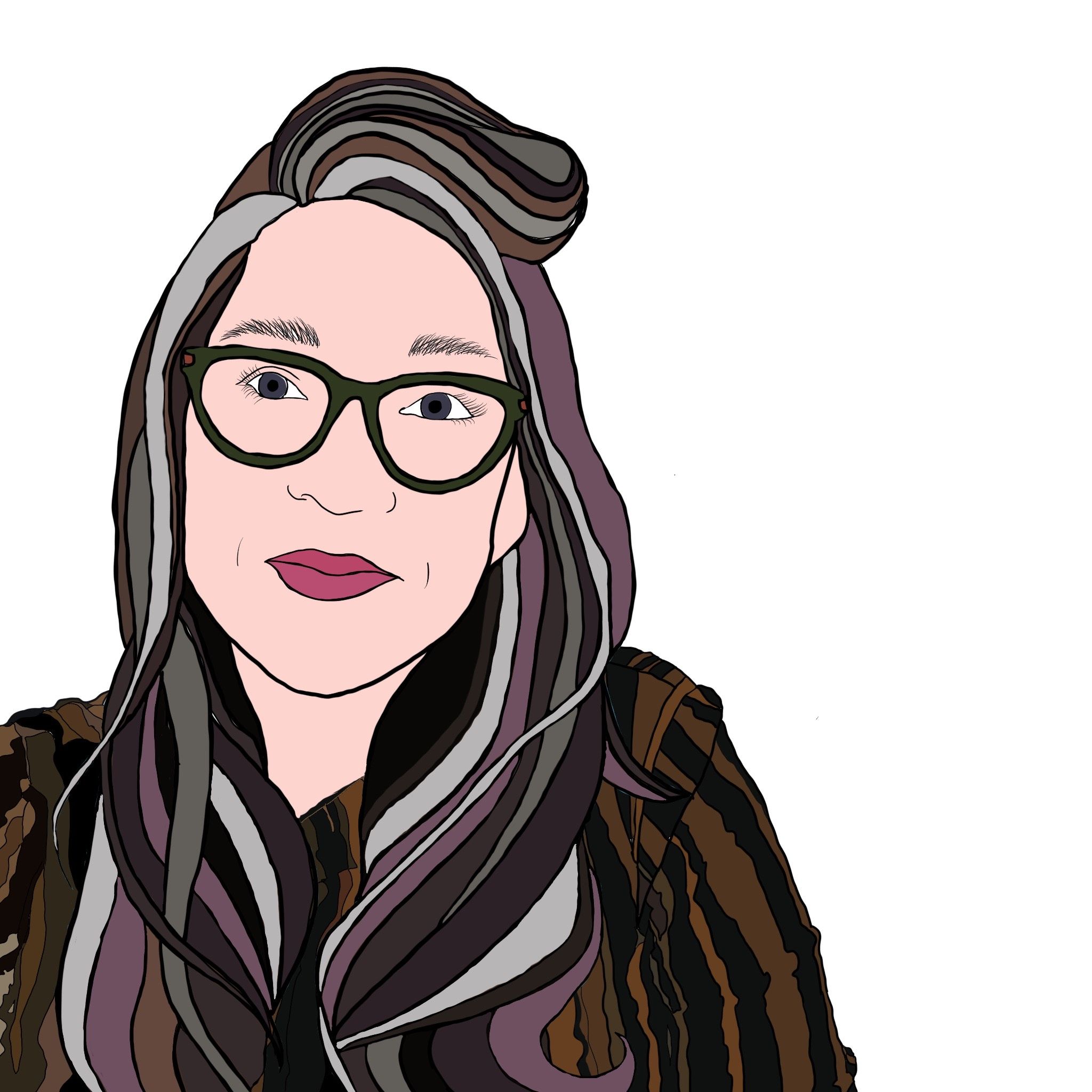

Your Instructor

Hadassah Damien is a strategist, artist, activist, small business owner, and creator of the iconoclastic blog and finance classes Ride Free Fearless Money. Her mission is to stabilize creative communities by empowering folks’ relationship to their money. Read more: http://www.ridefreefearlessmoney.com

Hadassah Damien supports individuals, partners, freelancers/small business owners, and collectives to create actionable financial plans through writing, online courses, 1:1 coaching sessions, and workshops. Real talk, honest compassion, hustle mindset, and intersectional needs all come into the equation, with excellent outcomes.

From people who get motivated and save their first $1,000, to people who buy homes and pay off their credit cards, freelancers who learn how to get $3,000 tax refunds, and couples who create a solid financial path together, her clients rave:

- "Her working class femme money genius has been an invaluable tool to help me figure out how to build my stability and start saving for retirement while meeting my goals and enjoying my life."

- "This course was a great way to get the support I needed to get my shit together, all in a way that aligns with my values, so thank you!"

- "I can’t think of a better form of self-care than to give your financial life the attention it deserves through Ride Free Fearless Money."

Ms. Damien is an educator, award-winning artist, civic technologist, and iconoclast who was raised working-class in Western NY. She puts the values she inherited both into practice and under microscopes in her progressive work. She has an MA from the CUNY Graduate Center, and an Honors BA from the University of Toronto.

And yes, she is a motorcyclist, which inspired the name Ride Free Fearless Money. When we ride, we do a LOT of work to make sure we're ready -- then we go enjoy the HELL out of the experience. Our finances can be handled well with a similar attitude: do the work, honor the work, and then go live your life!

Frequently Asked Questions

If you and your partner, partners, roommate/s, bestie, biz bestie, collective, cooperative, band, art tour or WHOEVER you're sharing money with want:

- a clear plan to nail down your money,

- video support to learn tools and step through the system,

- a ready-to-use conversation guidelines

- and have a shared money language ...

- and for the money to freakin make sense and not be an issue

...then you DEFINITELY want this course!

PLUS: We're in launch mode! New content is being added daily through 6/8> that means... You can start now and get the steps given to you.

The toolkit is cheaper than couples' therapy - not to mention cheaper than finding a new apartment/moving, cheaper than a few "I'm sorry dinners". I got you, when you're ready.