Calm That ACK! Budget and Save Money Master Course

Everything you need to know to unf*&k your money and start to save for YOU!

Enroll in Course

Ready to know how to control your finances, hook up the savings, and reduce your $$$ stress? Come and Calm That ACK!

For those who are ready to get a grip, Calm That ACK! is a two-hour+ self-guided course in dealing with money, setting goals you care about & factoring in debt — you'll get excited to unf*ck your budget and freakin’ save while you manage lots of priorities.

From a literal walk through on how to make a spending plan, to punk pep-talk frameworks, to loan hacks, a explanation of long term planning and more this class is JAMMED with easy-to-follow mega tricks via bite-size videos and handouts.

As a matter of fact, we start with the hardest thing first: an exercise designed to help you breathe deep and get your mental space ready to deal. Literally, we will calm your ACK in this class.

This a non-judgmental, positive, welcoming place to bring ANY financial experiences for folks across class backgrounds.

This class is FREAKIN AWESOME and I’m delighted to teach it from a progressive, no-judgement, no-wealth-worship, all real talk and useful tools perspective.

Scroll down for a preview or to sign up today.

"Oh my god, thank you for helping me change my life." -- A.

“The last webinar of yours that I took helped me a lot – I went from auto-saving $10 a week to $35 a week, and now I have $1000 in savings!! My all time best so far.” — RA

“I am so excited about having taken this step, and I’m noticing how much more aware and attentive I am to the money I’m spending every day. This course was a great way to get the support I needed to get my shit together, all in a way that aligns with my values, so thank you thank you thank you!” — T.

What you get is designed to help all kinds of learners - that includes you.

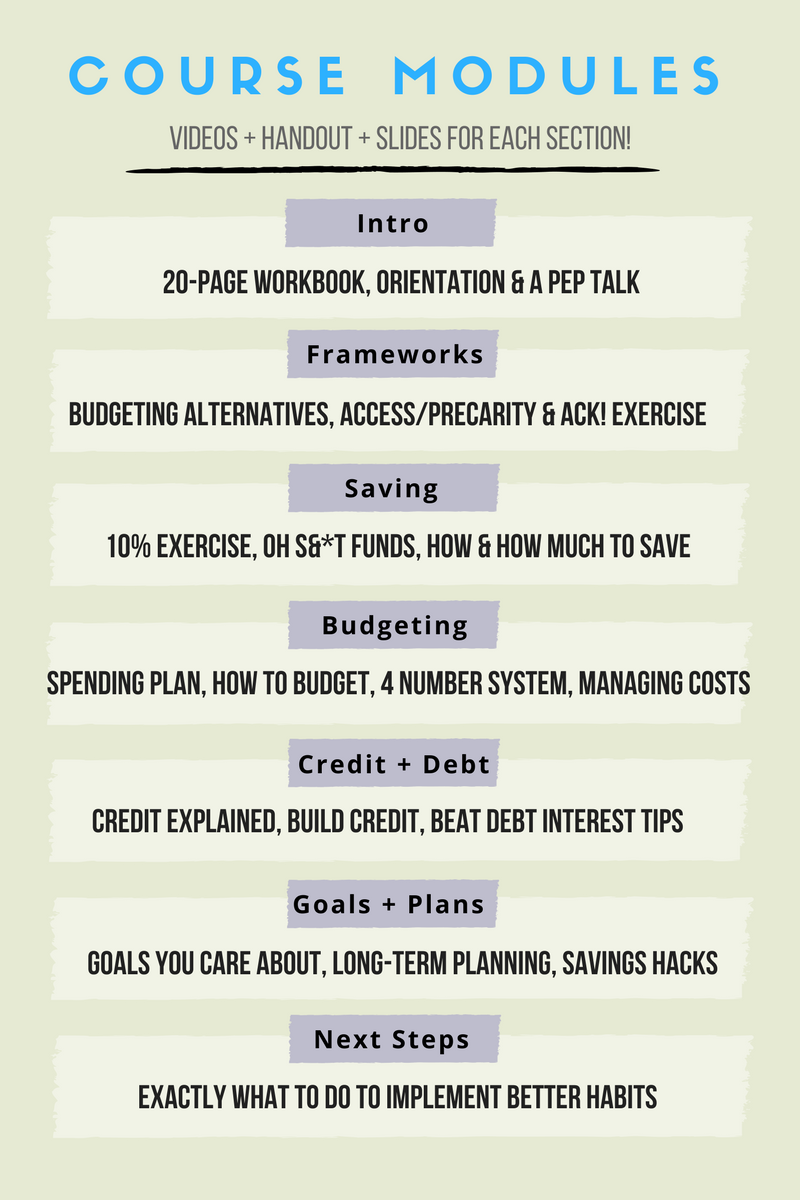

Check out the list of modules below -- once you sign up, you can jump in exactly where you need guidance or follow a framework in order.

The 31-page guided handout and workbook is a great resource to explain what to do, and you'll get a motivational email every 5 days for a month to keep you on track! BOOM -- you are doing this.

The steps and tools you get are sharp, clear, and awesome = learn today. Scroll down to sign up!

Here’s what’s about to happen with your next 60 bucks otherwise:

- You’ll go out to dinner – and it’s gone.

- You’ll pay off debt, not sure if you're being strategic

- You'll put it into saving but then buy crap with it and - poof.

Here’s what happens when you sign up and apply even a fraction of what you learn:

- If you apply any of this knowledge and make – or save – an extra $10/mo – that’s $120 in your pocket. Class paid for x2.

- If you apply any of this knowledge and make – or save – an extra $10/week – that’s $520 in your pocket. Class paid x 11.

- If you apply any of this knowledge and make – or save – an extra $10/day – that’s $3,650 in your pocket. Class paid x 90.

If you're ready to put a little time into getting a LOT of BIG change - let's do this!

Your Instructor

Hadassah Damien is a strategist, artist, activist, small business owner, and creator of the iconoclastic blog and finance classes Ride Free Fearless Money. Her mission is to stabilize creative communities by empowering folks’ relationship to their money. Read more: http://www.ridefreefearlessmoney.com

Hadassah Damien supports individuals, partners, freelancers/small business owners, and collectives to create actionable financial plans through writing, online courses, 1:1 coaching sessions, and workshops. Real talk, honest compassion, hustle mindset, and intersectional needs all come into the equation, with excellent outcomes.

From people who get motivated and save their first $1,000, to people who buy homes and pay off their credit cards, freelancers who learn how to get $3,000 tax refunds, and couples who create a solid financial path together, her clients rave:

- "Her working class femme money genius has been an invaluable tool to help me figure out how to build my stability and start saving for retirement while meeting my goals and enjoying my life."

- "This course was a great way to get the support I needed to get my shit together, all in a way that aligns with my values, so thank you!"

- "I can’t think of a better form of self-care than to give your financial life the attention it deserves through Ride Free Fearless Money."

Ms. Damien is an educator, award-winning artist, civic technologist, and iconoclast who was raised working-class in Western NY. She puts the values she inherited both into practice and under microscopes in her progressive work. She has an MA from the CUNY Graduate Center, and an Honors BA from the University of Toronto.

And yes, she is a motorcyclist, which inspired the name Ride Free Fearless Money. When we ride, we do a LOT of work to make sure we're ready -- then we go enjoy the HELL out of the experience. Our finances can be handled well with a similar attitude: do the work, honor the work, and then go live your life!

Course Curriculum

-

StartUnpacking Mental Constraint Models

-

StartHate "budgeting"? Then don't budget - try this instead. (6:52)

-

StartYour money is related to your access (2:53)

-

StartFear and Precarity (4:21)

-

StartExercise: Calm That Ack (5:46)

-

StartTrauma-Informed Money Practices (16:14)

-

StartCreating awesome habits from your practices

Frequently Asked Questions

If you are thinking about starting to make your money work better for you, why NOT now?

People let me know they pay off their credit cards, set up their first savings accounts and fill them to four-digits, and “magically” find the money to their teeth fixed after! (Trust me, it’s not magic, it’s intention and motivation.)

What's kept you from starting your money journey? I'd love to be the kickstarter to your engine and signing up for a paid class is a GREAT motivator. As they say: when we pay, we pay attention.

Plus, the earlier you start to pay down debt and save -- the more resources you have. It's really that simple.

If you want to join these ranks, enroll today:

- 100% of participants take two or more positive actions, changing their finances for the better

- 70% of participants take 5 or more positive actions less than one month after starting!

- 80% create and start using a budget they can stick with.